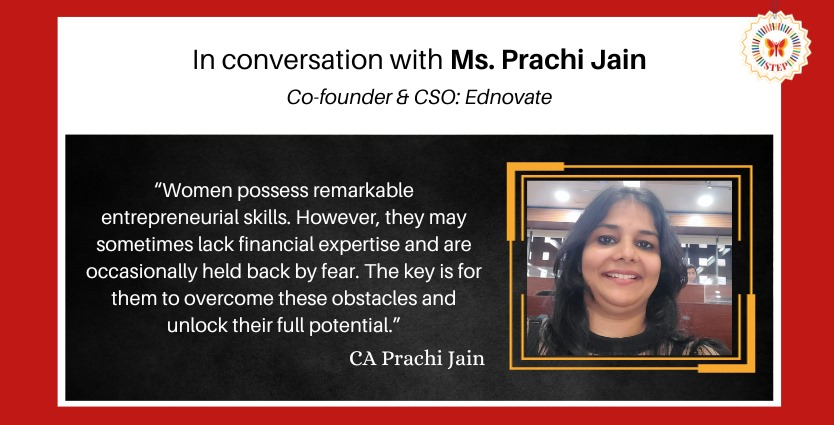

In conversation with Prachi Jain

“Darwin’s theory of evolution applies to startups as well. Like in nature, survival in the startup world depends on adaptation, seizing opportunities, and persistence. Just as species thrive in the right environment, startups, too, require a supportive ecosystem to flourish,” says Prachi Jain, Chartered Accountant, Company Secretary, LLB with 15+ years of diversified experience in the Private Equity and Venture Capital Industry.

The Professional Journey

Prachi hails from Gwalior, Madhya Pradesh, and initially wanted to become an IAS officer. However, following her father’s advice, she decided to pursue a career in Chartered Accountancy. She achieved the 19th All India Rank in the CA Level I exam on her first attempt, repeated her success in the second level, and secured a 42nd rank.

This success led to an internship at RSM & Co (acquired by PWC) in Mumbai, she acknowledges the guidance and mentorship of her seniors during this time.

“Moving from a small city to Mumbai was initially daunting and overwhelming, but I embraced the challenge because I wanted to fulfill my father’s dream and become a CA,” she adds.

During the same period, she successfully cleared the CS exams and earned a Bachelor of Law degree. Prachi believes in updating her skills and received a certificate in ESG Investing from CFA and also has a Gender Lens Investing Fellowship, Asia by 2x Global and Value for Women. The latest feather in her cap is the Goldman Sachs Entrepreneurship course from IIM Bangalore.

Her professional journey coincided with India’s financial boom in 2004-2005. She joined a private equity fund, specializing in food and agribusiness sustainable investments.

“My expertise in fund and transaction structuring along with financial acumen developed during articleship proved invaluable,” she admits.

During her 9 year tenure, the fund successfully raised $50 million and invested $26 million in nine portfolio companies.

She took a sabbatical to care for her premature child and later joined an investment banking firm, but she did not find it interesting.

In 2018, she became a part of Achieving Women Equity (AWE), India’s first gender-focused fund, where she served as a Director. She played a pivotal role in setting up funds and policy development and successfully raised approximately INR 125 crores with her team.

After dedicating over 15 years to the investment industry, she reached a point in her life where she wanted to explore a new path. She decided to become an entrepreneur to leverage her expertise and skills.

Prachi started as a strategic advisor to Ednovate and joined full-time in January 2023 as a Co-founder and CSO.

“Being an entrepreneur is incredibly satisfying because you’re in charge and juggling various tasks simultaneously. It is also an added joy when your business contributes positively to your community,” she adds.

About Ednovate

Ednovate is an education platform that aims to provide a one-stop solution to Commerce and CA students and handhold them through their entire course journey. What sets it apart is that it provides the feeling of an institution to students, as CA is a correspondence course. Ednovate is also solving the macro level problem of demand-supply mismatch of availability of CAs in India. Ednovate has a better passing % ratio – 48% to 70% as compared to ICAI’s 5% to 25%.

Recognizing a gap, the founders of Ednovate – all Chartered Accountants, launched Ednovate to address the pain points faced by students during covid.

“ We introduced an online immersive learning platform for CA students, including doubt-solving sessions, a 24*7 helpline, and rigorous writing practice. Our efforts resulted in the success of 13 students achieving All India ranks in the first batch at CA Final and CA Inter Level,” she says.

As pandemic restrictions eased, Ednovate expanded its services to include offline centers to foster social interactions, peer support, and the fun aspects of learning.

Ednovate quickly grew from having 4 centers in Mumbai to establishing 11 centers across India, enrolling over 10,000 students in less than two years of operation.

“The CA journey can be lonely, and we aim to provide holistic support including individual and group mentorship, opportunities for parent interactions, assistance in finding articleship placements through our network, and help with securing job placements,” she adds.

The Ednovate team is relatively young, with an average age of 27 years. They have ambitious plans for the future, including expanding their offerings to cover Company Secretary (CS), Chartered Financial Analyst (CFA), and Certified Public Accountant (CPA) programs and reaching out to tier 2-3 cities.

Why do startups fail?

- Lack of Market Need: One of the most critical reasons for startup failure is developing a product the market does not need or cannot support. Startups must align their offerings with a genuine market need, or they risk becoming the next Orkut – a product ahead of its time with no demand.

- Ignoring Cash Flow: Many startups ignore the importance of cash flow management. They may overestimate their runway, spend too quickly, and fail to secure necessary funds leading to financial instability and even closure.

- Team Dysfunction: A right team is crucial for a startup’s success. Co-founders or key team members should share the same vision and work well together. Internal conflicts, ego clashes, or a lack of cohesion can hinder progress or lead to failure.

- Underestimating Competition: Even with a unique idea, underestimating competition can be dangerous. The market can attract new entrants or existing players looking to capitalize on the same opportunity. Startups must continuously evaluate their competitive landscape.

- Poor Product Quality: Developing a product that fails to meet customer requirements or lacks quality can quickly lead to failure. In today’s market, customers have high expectations, and subpar offerings will drive them away.

- Pricing Strategy: Setting the right price for your product or service is essential. Pricing too high can alienate potential customers, while pricing too low can lead to unsustainable business operations.

- Inadequate Marketing: Startups need to be visible in the market to attract customers. An ineffective marketing strategy, whether too aggressive or too passive, can have adverse effects. A balanced approach, understanding customer needs, and delivering a compelling message are essential.

- Timing and Scaling: Timing is crucial in the startup world. Scaling too fast or too slowly can be detrimental. Understanding when to expand is a challenging but necessary decision.

- Pivoting Wisely: Pivoting from a startup’s core strengths to a completely different vertical should be cautiously approached. A startup’s core competence is its foundation, and pivoting should either leverage that strength or involve the right team and expertise.

- Persistence and Passion: Building a startup requires dedication and enthusiasm. Founders need to hustle every day, ensure their employees are paid, and maintain a positive attitude, even in the face of challenges.

Strategies for Successful Startup Fundraising

- Raise funds when you need it

- Raise the optimal amount of funds

- Approach the right investors

- Narrate a compelling story in your pitch deck

Prachi reveals the specific criteria she considers when evaluating and selecting startups for investments.

- Sustainability and profitability of the startup

- The passion of founders and promoters

- Potential to scale according to market size

- Value Proposition of the product

Importance of choosing the right investors

“Picking the right investor is crucial for funding, and it depends on what your startup is all about. It’s similar to committing to a marriage with a set divorce date; you should cooperate well to make your startup thrive,” she suggests.

Commercial Startups: If you are building a commercially focused startup, venture capitalists (VCs) who specialize in this domain are the right fit. They understand the dynamics of startups and can provide the necessary capital and guidance.

Impact-Driven Startups: For startups with a social or environmental impact focus, it’s crucial to seek out investors who comprehend and value impact.

Equity Preservation: If you aim to avoid diluting your equity, grant investors, primarily governmental bodies, offer an attractive option, as these entities provide non-equity-based financial support.

Mentorship and Know-How: For startups looking for mentorship, guidance, and industry-specific expertise, incubators, and accelerators are valuable resources, as they offer structured programs and access to a network of experienced professionals.

“Researching your options and understanding investor preferences can significantly increase your chances of securing the right funding and support,” she adds

Message to women entrepreneurs

“Women possess remarkable entrepreneurial skills. However, they may sometimes lack financial expertise and are occasionally held back by fear. The key is for them to overcome these obstacles and unlock their full potential,” is her message to women entrepreneurs.

Prachi, the person

Motivated by a deep desire to make a positive impact on society and become a better version of herself, Prachi draws inspiration from her parents, Ms.Kiran Bedi, and her seniors – Partha Choudhury and Ashalata Shettigar.

She prefers hills to beaches. A quote that is the mantra of her life is, “Live life to the fullest. Strive to be a better version of yourself and do not take life too seriously.”